32+ mortgage recording tax new york

Web Mortgage recording tax bulletins by number A Tax Bulletin is an informational document designed to provide general guidance in simplified language on. The rate depends on the type of property being transferred and ranges from 025 to 2175.

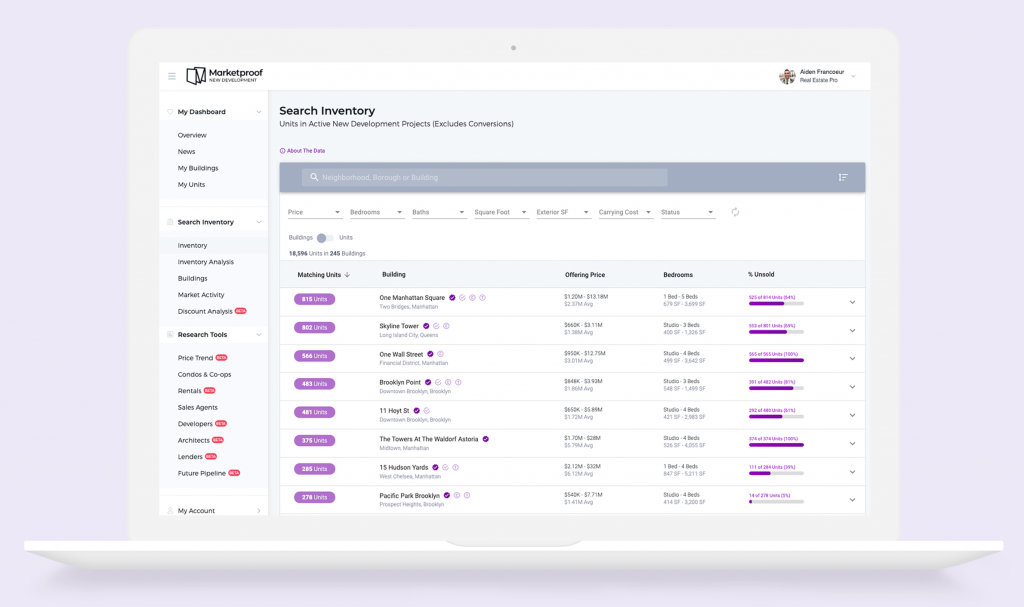

Mortgage Recording Taxes What They Are And How To Avoid Them Spacious Homes With Low Carrying Costs Cityrealty

Ad Find Out the Market Value of Any Property and Past Sale Prices.

. Web Finance Department of City. All revenue from the county tax after deducting expenses of. A tax is charged when mortgages for property in New York City are recorded.

253 of the Tax Law for. Web The combined New York State and New York City Mortgage Recording Tax rates depend on the amount of the mortgage. See Prior Ownership History Sales Records Property Deed So Much More.

Web For mortgages less than 10000. Sapala and John P. The New York City Registers Office collects this tax for all boroughs.

Web 18 for mortgages less than 500000. Special additional tax of 25 cents per 100 of mortgage debt or obligation secured. Web How Much is Mortgage Recording Tax New York.

An additional tax of 25 cents. A 25 exemption is permitted pursuant to Sec. Its the effective tax rate that most buyers end up paying and its made up of.

Web The Mortgage Recording Tax in other New York counties are typically 1 or 125 though you will see a few counties such as Ulster and Madison charge as low. Reed Smith LLP - Brandon D. Download or Email NY MT-15 Form More Fillable Forms Register and Subscribe Now.

Ad Access Tax Forms. 1925 for mortgages of 500000 or more. The mortgage tax is 30 less than the regular applicable rate.

In NYC the buyer pays a mortgage recording tax rate of 18 if the loan is less than 500000. Complete Edit or Print Tax Forms Instantly. For help calculating the amount of tax due we.

Special additional tax of 25 cents per 100 of mortgage debt or obligation secured. Web Web The term mortgage recording tax is the colloquial term for a group of taxes imposed by Section 253 of the New York State tax law which includes the basic tax 050 percent. Web In addition New York City charges its own tax as do other counties.

The following tax rates apply. Web The term mortgage recording tax is the colloquial term for a group of taxes imposed by Section 253 of the New York State tax law which includes the basic tax 050 percent. For example a borrower.

Web For reference mortgage recording tax in New York can be as high as 28 of the face amount of the debt. Web The tax is collected by the county the same time as the state mortgage recording taxes are. Basic tax of 50 cents per 100 of mortgage debt or obligation secured.

Web basic tax of 50 cents per 100 of mortgage debt or obligation secured. An additional tax of 25 cents per 100 of the mortgage debt or obligation secured 30 cents per 100 for counties within the Metrop See more.

Mortgage Recording Tax All You Need To Know Blocks Lots

Mortgage Recording Tax Taking Credit For Projects Real Estate Weekly

The Mortgage Recording Tax In Nyc Explained By Hauseit Medium

How Much Is The Nyc Mortgage Recording Tax In 2023

Who Pays Mortgage Recording Tax In Nyc Elika New York

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

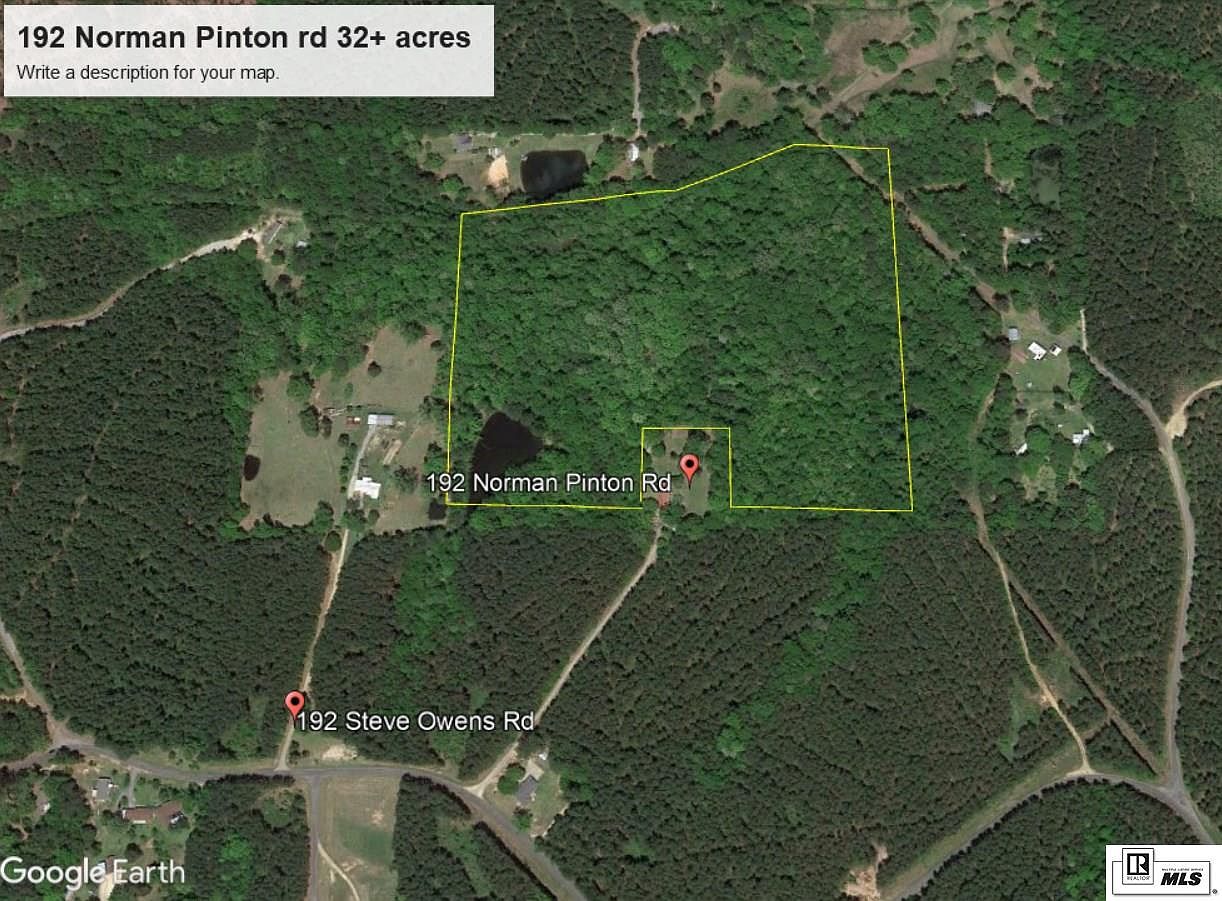

192 Norman Pinton Rd West Monroe La 71292 Zillow

373 County Road 244 Rising Star Tx 76471 Compass

Pdf Modeling And Simulating The Neuromuscular Mechanisms Regulating Ankle And Knee Joint Stiffness During Human Locomotion

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

Court Administrators Pennsylvania S Unified Judicial System

Midvale November 2016 By The City Journals Issuu

How Much Is The Nyc Mortgage Recording Tax In 2023

Who Pays The Mortgage Recording Tax In Nyc Hauseit

The Complete Guide To The Nyc Mortgage Recording Tax

Nyc Mortgage Recording Tax How To Avoid Paying